|

<< Click to Display Table of Contents >> AP Vendor Maintenance Page 2 |

|

|

<< Click to Display Table of Contents >> AP Vendor Maintenance Page 2 |

|

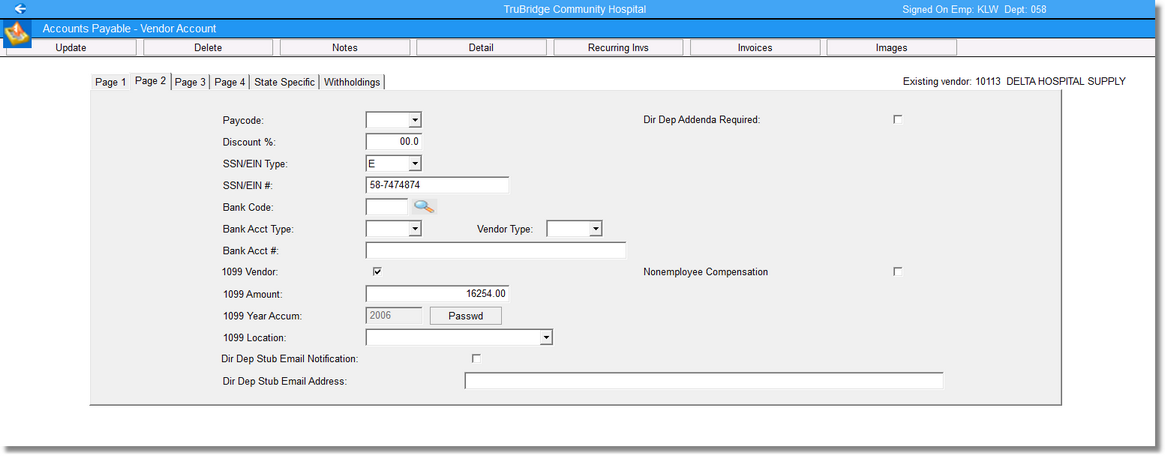

Select Web Client > System Menu > Accounts Payable > Vendors > Page 2

Accounts Payable - Vendor Account, Page 2

•Pay Code: A Pay Code of N may be manually entered if the vendor does not need to be paid at the time of printing checks, even though there may be outstanding invoices. A check will not be generated for this vendor when Pay Code N is used. The Pay Code may be removed at a later time so that the system will then generate a check for the vendor.

•Discount %: The normal discount that a vendor allows is entered in this field. When checks are printed, the system will automatically take the percentage discount allowed by the vendor.

If the vendor normally does not give discounts, a percentage discount should not be entered in this field. For those occasions when a discount is to be given, the system will allow a specific dollar amount to be entered in the discount field when entering the individual invoices.

If the organization is “for profit” and the invoices typically include a sales tax, a percentage discount should not be entered in this field. Otherwise, the system will calculate a discount on the sales tax. The system will allow a specific dollar amount to be entered in the discount field when entering the individual invoices.

•SSN/EIN Type: Enter S if the Vendor will be using a Social Security Number to track 1099 amounts. Enter E if the Vendor will be using a Federal Identification Number to track 1099 amounts.

•SSN/EIN #: This field is used for the vendors who will receive a 1099 at year-end. The Social Security Number or the Federal Identification Number of the vendor receiving a 1099 should be entered in this field. Enter the number without using dashes.

•Bank Code: The vendor’s Bank Code should be entered in this field when using direct deposit.

•Bank Acct Type: Enter the Vendor’s account information in this field when using direct deposit.

•Bank Acct #: Enter the Vendor’s account information in this field when using direct deposit.

•NOTE: The Bank Code, Bank Account Type and the Bank Account Number will need to be set up in the Payroll module before they may be entered in the Vendor Master. Contact a TruBridge Support Representative for more information.

•1099 Vendor?: Select this option if this Vendor should receive a system-generated 1099-MISC form or a 1099-NEC form at year-end or leave blank if this vendor will not receive a system-generated 1099-MISC form 1099-NEC form at year-end.

•Nonemployee Compensation: Select this option if this Vendor should receive a system-generated 1099-NEC form at year-end or leave blank if this vendor will not receive a system-generated 1099-NEC form at year-end.

NOTE: If the selected vendor should receive a 1099-NEC form at year-end, both the 1099 Vendor field and Nonemployee Compensation fields selected.

•1099 Amount: The 1099 amount field is used only for the vendors that are created in the Vendor Master after the current year begins, but will need to receive a 1099 at year-end. The total dollar amount the vendor has received from January 1 to the date the Vendor Master is created should be entered in this field.

•1099 Year Accum: The system will record and track all amounts paid to a vendor after the Vendor Master is created. When the system purges vendor activity, the purged amount paid to the vendor will be added to this field, along with the year the amounts were paid. When 1099’s are run at year-end, the amount in this field will be added to the current account detail amount if the Accum Year is equal to the year that 1099’s are being run.

•1099 Location: This field determines where the amount prints on the 1099 form. If the field is left blank, the amount prints in the Misc box. Select an option from the drop-down box. If A Attorney (bx 10 MISC) is selected, the amount prints in the Gross proceeds paid to an attorney box on the 1099-MISC. If I Nonemp Comp (bx 1 NEC) is selected the amount prints in the non-employee compensation box on the 1099-NEC. If M Medical (bx 6 MISC) is entered, the amount prints in the Medical & Healthcare payments box on the 1099-MISC. If O Other (bx 3 MISC) is entered, the amount prints in the Other Income box on the 1099-MISC. If an R Rents (bx 1 MISC) is entered, it prints in the Rents box on the 1099-MISC.