|

<< Click to Display Table of Contents >> Description and Usage |

|

|

<< Click to Display Table of Contents >> Description and Usage |

|

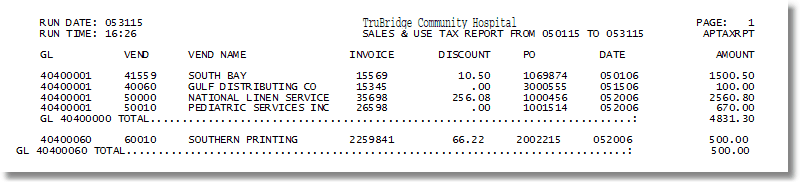

The report prompts for a beginning and ending date which is used to enter the desired transaction date range. All invoices with the “Tax Report?” switch marked Y and the transaction date within the date range selected, will pull to the report.

Sales & Use Tax Report

Listed below is an explanation of each column.

•GL (General Ledger Account Number): That was expensed during Invoice Entry.

•Vendor (Vendor Number): Pulls from the Vendor Master.

•Name (Vendor Name): Pulls from the Vendor Master, Page 1.

•Invoice (Invoice Number): Pulls from Invoice Entry.

•Discount: Pulls from Invoice Entry and is the amount of the individual invoice discount.

•PO (PO Number): Pulls from Invoice Entry.

•Invoice Date: Pulls from Invoice Entry.

•Amount: The Invoice Amount pulls from Invoice Entry.