|

<< Click to Display Table of Contents >> Description and Usage |

|

|

<< Click to Display Table of Contents >> Description and Usage |

|

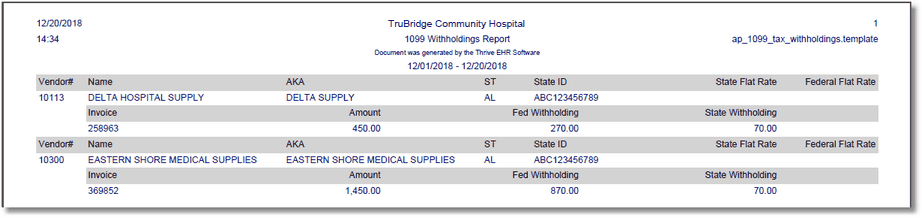

The 1099 Withholdings Report will display State and/or Federal Withholdings information for vendors who are set up to have withholdings This report will help determine the state and federal withholding amounts that may display when printing 1099's. A summary of states with withholdings and a summary of vendors with withholdings will display at the end of the report.

1099 Withholdings Report

Listed below is an explanation of each column:

•Vendor #: Pulls the Vendor Number from Page 1 of the Vendor Master.

•Name: Pulls the Vendor Name from Page 1 of the Vendor Master.

•AKA: Pulls the Vendor's Also Known As name from Page 1 of the Vendor Master.

•ST: Pulls the State Code from the Withholdings tab of the Vendor Master.

•State ID: Pulls the State ID Number associated with the State from the Withholdings tab in Control Options.

•State Flat Rate: Pulls the State Flat Rate from the Withholdings tab of the Vendor Master, if applicable.

•Federal Flat Rate: Pulls the Federal Flat Rate from the Withholdings tab of the Vendor Master, if applicable.

•Invoice: Displays invoices entered in the selected date range that have withholdings information.

•Amount: Displays the amount of the invoice.

•Fed Withholding: Displays the total Federal Withholding amount of the invoice.

•State Withholding: Displays the total State Withholding amount of the invoice.

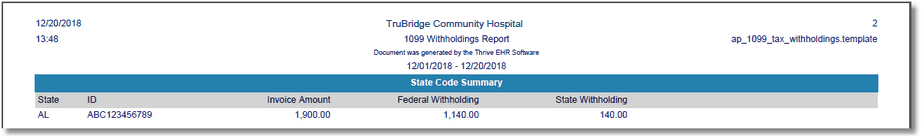

State Code Summary

Listed below is an explanation of each column:

•State: Pulls the State Code from the Withholdings tab of the Vendor Master. This column will list each state with withholding information for the selected date range.

•ID: Pulls the State ID Number associated with the State from the Withholdings tab in Control Options.

•Invoice Amount: Pulls the total amount of all invoices, with Withholdings, associated with the state.

•Federal Withholding: Pulls the total Federal Withholding amount from all invoices associated with the state for the selected date range.

•State Withholding: Pulls the total State Withholding amount from all invoices associated with the state for the selected date range.

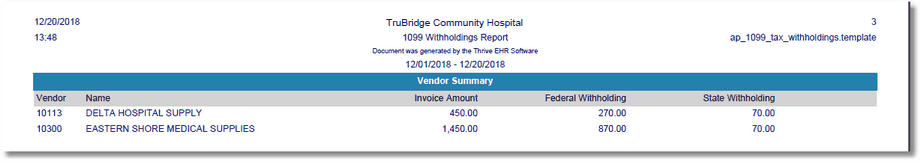

Vendor Summary

Listed below is an explanation of each column:

•Vendor: Pulls the Vendor Number from Page 1 of the Vendor Master. This column will list each vendor with withholding information for the selected date range.

•Name: Pulls the Vendor Name from Page 1 of the Vendor Master.

•Invoice Amount: Pulls the total amount of all invoices, with Withholdings, for the vendor

•Federal Withholding: Pulls the total Federal Withholdings amount from all invoices associated with the vendor for the selected date range.

•State Withholding: Pulls the total State Withholdings amount from all invoices associated with the vendor for the selected date range.