|

<< Click to Display Table of Contents >> Update |

|

|

<< Click to Display Table of Contents >> Update |

|

The following fields are completed during Invoice Entry. The information entered may be changed through Existing Invoices.

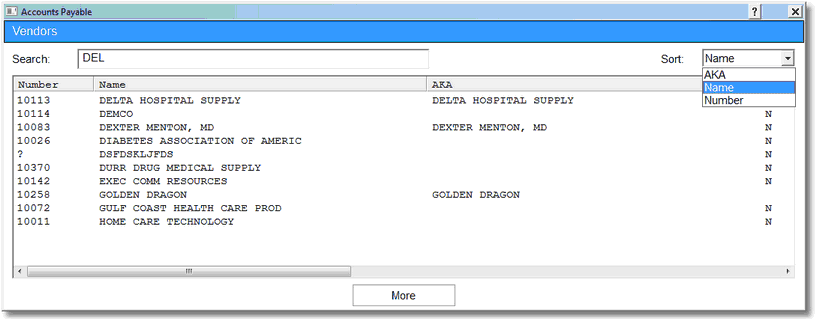

•Vendor: Entering a ? in the Vendor field will display the following vendor lookup.

Vendors

When looking up a vendor, the Sort option will allow the system to search by Vendor Name, Vendor Also Known As Name or the Vendor Number. Select the desired vendor from the displayed list to continue.

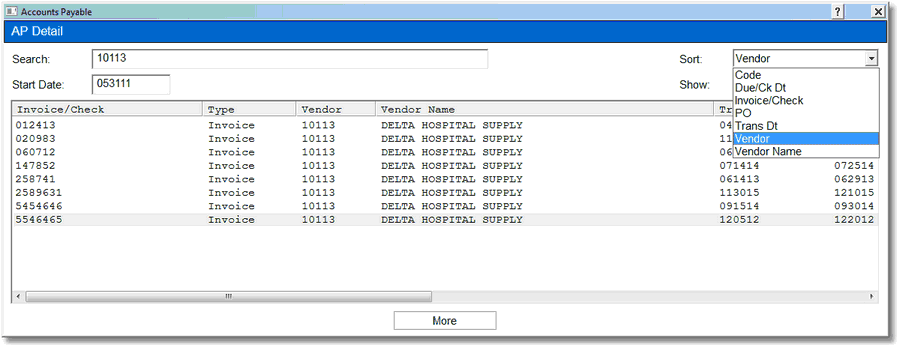

•Invoice: Entering a ? in the Invoice field will display the following invoice lookup.

AP Detail

When looking up an Invoice, the Sort option will allow the system to search by Code, Due/Check Date, Invoice/Check Number, Purchase Order Number, Transaction Date, Vendor Number or Vendor Name. Select the desired vendor from the displayed list to continue.

When making changes to an invoice that has been moved to permanent file, the Invoice Number, Invoice Date, Due Date, Pay Code, Discount and Discount Calculation and the AP Memo may be changed. After changes are made to the existing invoice, select Update to save the changes entered. The Transaction Date, the dollar amount of the invoice, the Batch Number and the Sequence Number cannot be changed because they are a part of the permanent record.

In Invoice Maintenance, the Invoice Number and Pay Codes are two of the fields that may be changed. To change the Invoice Number, select Change to the right of the existing Invoice Number. The system will prompt “New invoice number”. Enter the new Invoice Number and select OK. The system will display the new Invoice Number on the screen. An * will appear to the right of the Change option. Selecting the * will display the original Invoice Number. If the Invoice Number is changed multiple times, the system will only retain the current number and the original number.

NOTE: If the Pay Code of the invoice has ever been Paid, the Invoice Number cannot be changed. The change in the Invoice Number will not be reflected in General Ledger detail. General Ledger will retain the original Invoice Number.

The Pay Code field will also display an * if the Pay Code has been changed. Selecting the * will display the status of the check as PAID, the Paid Date and the Bank Code.

•Trans Date: The Transaction Date pulls from Transaction Entry once the invoice is keyed and moved to permanent file. General Ledger has been affected by this date; therefore, the date cannot be changed.

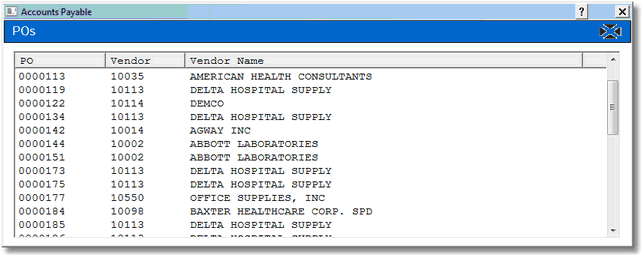

•PO: The PO is the Purchase Order number that pulls from the Invoice Entry. This field may be changed at any time by entering the Invoice Maintenance Screen and over-keying the existing number. Entering a ? in the PO field will display the following lookup.

POs

•Invoice Date: The Invoice Date is used for information purposes only and may be changed at any time by entering the Invoice Maintenance Screen and over-keying the existing date.

•Due Date: The Due Date field is used to show the date the payment is due. When checks are printed, the system will prompt “Cut-off Due Date”, and only the invoices with this Due Date or any date prior to this date will be printed. This field may be modified at any time prior to the printing of the checks by entering the Invoice Maintenance Screen and over-keying the existing date.

•Pay Code: The Pay Code field indicates whether an invoice should be paid or left unpaid. If this field is left blank, the invoice will be paid when checks are generated and theinvoice meets the entered parameters. If the invoice does not need to be paid at this time, an N may be entered in this field prior to printing checks to prevent it from being included in the check-writing file. Once the invoice needs to be paid, the Pay Code should be set back to blank. After checks are printed and finalized, the system will automatically place a P in this field indicating this invoice has been paid. If manually entering a Pay Code of P, the Check Date field should be completed. An "Are You Sure (Y/N)?" prompt will display if there is an attempt to change or remove a Pay Code of P. If answered N the P Pay Code will remain. If answered Y, the field will reflect the change. This field may also contain M if more than one check will be written for this invoice. When M is entered a "Multi" option will appear on the screen and the Due Date field will display "Multi".

•Check: Dt: Bank: The Check portion of this field is the check number used to pay the invoice. Dt is the date the check was written. Bank is a code created for each checking account that is to produce checks from the system. This is a three-digit code set up in the Accounts Payable Control Options that is facility defined.

•Amount: This field contains the total dollar amount of the invoice.

•Discount: The discount amount field shows the amount of discount a vendor allows. This is calculated based on the discount percentage loaded in the Vendor Master. This may be changed at any time prior to printing checks by entering the Invoice Maintenance Screen and over-keying the existing discount. The system will take the new discount when checks are printed.

•1099 Total?: This field indicates if this invoice will be included in the system-generated 1099 run. Selecting this field will include this amount on the 1099. If left blank, the invoice total will not be included on the 1099. This prompt may be changed any time prior to running 1099’s. If the 1099 Vendor field is selected within Vendor Master, this field will default to being selected on any future invoices.

•Tax Report: By default, the Tax Report field will not be selected when entering invoices. If selected, the invoice will pull to the Sales and Use Tax Report. This report identifies, by invoice, if an expense is taxable or nontaxable.

•AP Memo: This is a free text field that can be included on the check stubs during the check printing process. This memo line will not pull to General Ledger.

•Multi-Payments: This field displays the dollar amount that has been distributed for the invoice in the Multi-Pay option. This may be used to determine if more payments will need to be entered in order to ensure the entire dollar amount of the invoice will be paid.

•Cap Project # Year Amount: The Capital Project # from General Ledger should be loaded in this field if this invoice should subtract from the project's budget. If more than one project is added to an invoice, then the invoice would need to indicate via the % or $ fields what portion of the invoice amount applies to that project. If only one project is added to an invoice then the % and $ fields would not need to be completed and would default to 100% of the invoice amount.

NOTE: If the Capital Project # is loaded on the Vendor Maintenance, it will not be necessary to load the project number on the invoice.

•Expense Distribution: The Expense Distribution information will display but cannot be changed. The GL # field represents the General Ledger numbers that were expensed for this invoice. The Description is the General Ledger name that was expensed for this invoice. The Amount is a breakdown of the expenses for each General Ledger number.

•CS Num: The CS Number is the cp or cpware login number that was used to enter the invoices.

•Batch Num: The entire batch number is seven digits long and is made up of both the CS Number and batch number. The first three digits indicate the cp or cpware login number where the invoices were keyed. The last four digits indicate the batch entry for the CS Number. As the invoices are being keyed, they are held in a temporary file until all invoices are keyed and ready to move to permanent file. With each temporary file, a new batch number is created. For example, if the cpware number is 278, then the first batch number for this login will be 2780000. After this batch is moved to permanent file, the next batch number for this sign on will be 2780001. The batch number appears in the Accounts Payable and General Ledger account details and cannot be changed.

•Seq: The sequence number indicates the location within the batch for this invoice. This is the sequence number of the entries on the Transaction Edit List that is run to post entries to permanent file. For example, in the batch 2780000, the first invoice keyed will have a sequence number of 001, and the second will be 002, etc. This number is helpful in locating the entry on the Transaction Edit List. This number appears in the Accounts Payable and General Ledger account details and cannot be changed.