|

<< Click to Display Table of Contents >> Description and Usage |

|

|

<< Click to Display Table of Contents >> Description and Usage |

|

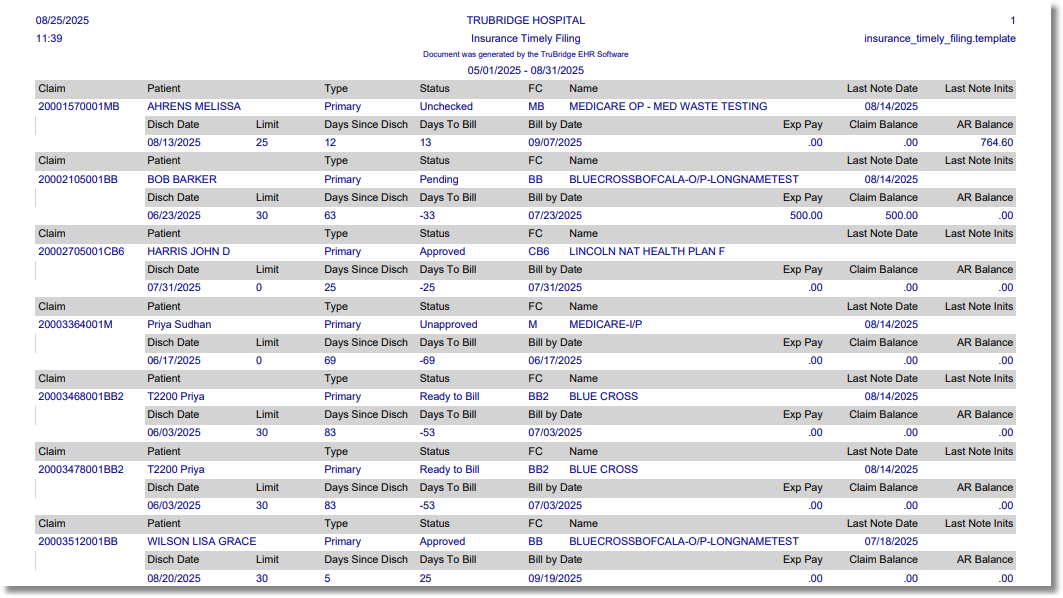

The Insurance Timely Filing Report aids in monitoring insurance claims to ensure they are billed, or re-billed, within a payor's Timely Filing Standards. The report enables staff to quickly identify claims at risk of missing Timely Filing deadlines, prioritize follow-up, and reduce potential revenue loss by providing key details for each claim: financial class, claim status, days since discharge, days remaining to file, filing due date, expected reimbursement, charges, and AR Balance.

In order for this report to pull accurate data, the Timely Filing fields in the Insurance Companies Table, Page 9 must be completed for each Financial Class.

The Report Writer application allows the user to filter, sort and manipulate this report so the data may be customized and extracted out of the system. See the additional documentation on Report Writer for more information on these options.

Insurance Timely Filing Report

Insurance Timely Filing Report

Listed below is an explanation of each column.

•Claim: This pulls the claim number from the Claim Status Screen.

•Patient: This pulls the patient name from the patient account.

•Type: This indicates the claim type: Primary, Secondary, or Tertiary from the Policy Information Screen.

•Status: This column pulls the claim status from the Insurance System.

•FC: This column pulls the Financial Class Code from the account.

•Name: This column pulls the description of the Financial Class Code from the Insurance Companies Table.

•Last Note Date: This will pull the date of the last Note with the code "N" that was left on the Account Detail screen for the account.

•Last Note Inits: This reflects the initials of the user who left the last Note with the code "N" on the Account Detail screen for the account.

•Discharge Date: This column pulls the Discharge Date from the account.

•Limit: This column pulls from the "Days to Bill" field in the Insurance Companies Table, Page 9, for the Financial Class Code.

•Days Since Discharge: The column pulls the number of days since the Discharge Date.

•Days to Bill: This will reflect the number of days left to bill the claim in order to meet Timely Filing requirements.

▪Primary Claims: The system will use the number of days since discharge and the number of days loaded in the Days to Bill Primary field on the Insurance Companies Table, Page 9, to calculate the number of days left to meet Timely Filing.

▪Secondary Claims: The system will use the Receipt/Remit Date of the Primary claim and the number of days loaded in the Days to Bill Secondary/Tertiary field on the Insurance Companies Table, Page 9, to calculate the number of days left to meet Timely Filing.

▪Tertiary Claims: The system will use the Remit Date of the Secondary claim and the number of days loaded in the Days to Bill Secondary/Tertiary field on the Insurance Companies Table, Page 9, to calculate the number of days left to meet Timely Filing.

▪Late Charges: When late charges are added to an account after the Primary claim has been billed and another claim for the same Financial Class is created to bill the late charges only, the system will use the Days Since Discharge number and the Days to Bill Primary field on the Insurance Companies Table, Page 9 to calculate the number of days left to meet Timely Filing.

▪Corrected Claims: The system will use the Original Claim Receipt/Remit Date against the Days to Refile field on the Insurance Companies Table, Page 9, to calculate the number of days left to meet Timely Filing. The system identifies Corrected Claims as claims with a Type of Bill of **7. The

NOTE: For claims with late charges, "Days Since Discharge" will be calculated using the Billed Date of the first claim to the current date (the date the report is run).

•Bill by Date: This field calculates the date in which the claim should be billed based on the calculation in the Days to Bill field.

•Exp Pay: This pulls the Expected Pay amount from the Claim Status Screen.

•Claim Balance: This pulls the total charges for the claim.

•AR Balance: This pulls the AR Balance from the Account Detail for the account.