|

<< Click to Display Table of Contents >> Description and Usage |

|

|

<< Click to Display Table of Contents >> Description and Usage |

|

The Accountants Report shows the aging of accounts based on the criteria selected, such as Credits, In-House and Financial Class. It is an optional report that may be utilized by the Business Office to monitor patient accounts with outstanding balances.

All accounts will only fall into one report type (i.e. Credits, Inhouse, Medicare etc.). This is to prevent the total AR from adding accounts multiple times. The accounts will only show in the first report type it hits.

•The order of the report types are:

▪Credits

▪Inhouse

▪Blue Cross

▪Rehabilitation

▪Medicaid

▪Medicare

▪Commercial

▪Private Pay

•For example: If an account has a credit balance, no discharge date, and a Medicare insurance, it would fall into the Credits type category since it is the first report type. If a report type of Medicare or Inhouse was to be selected, the account would not be included.

•If the current financial class on an account starts with a "P" (i.e. P, PB, PB1) or it is blank, the account will be considered Private Pay.

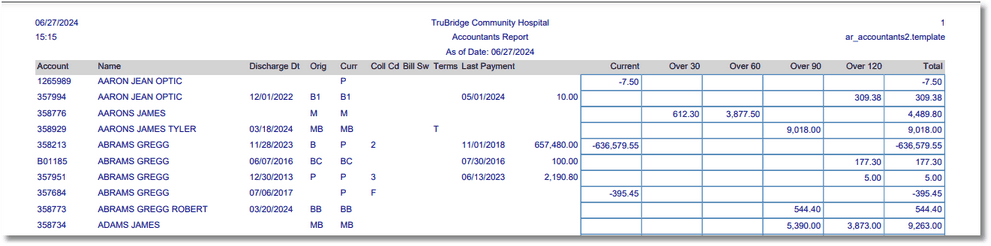

Accountants Report

Accountants Report (Report Summary Only)

Listed below is an explanation of each column.

•Account: Pulls from Patient Functions.

•Name: Pulls the patients name from the Patient tab on the Registration and ADT screen

•Discharge Date: Pulls from the Stay tab on the Registration and ADT screen

•Orig (Original Financial Class): Pulls from the Guarantor/Ins tab on the Registration and ADT screen

•Curr (Current Financial Class): Indicates the current outstanding insurance

•Coll Cd (Collect Code): Pulls from the Guarantor/Ins tab on the Registration and ADT screen

•Bill Sw (Bill Switch): Pulls from the Guarantor/Ins tab on the Registration and ADT screen

•Terms: Indicates if the account is set up for terms payments

•Last Payment (Date): Located in the A/R Account Status. The next column displays the last payment amount.

•Current: The current amount due (less than 30 days for discharge date)

•Over-30: The amount due over 30 days from discharge date

•Over-60: The amount due over 60 days from discharge date

•Over-90: The amount due over 90 days from discharge date

•Over-120: The amount due over 120 days from discharge date

•Total: The total amounts for each column

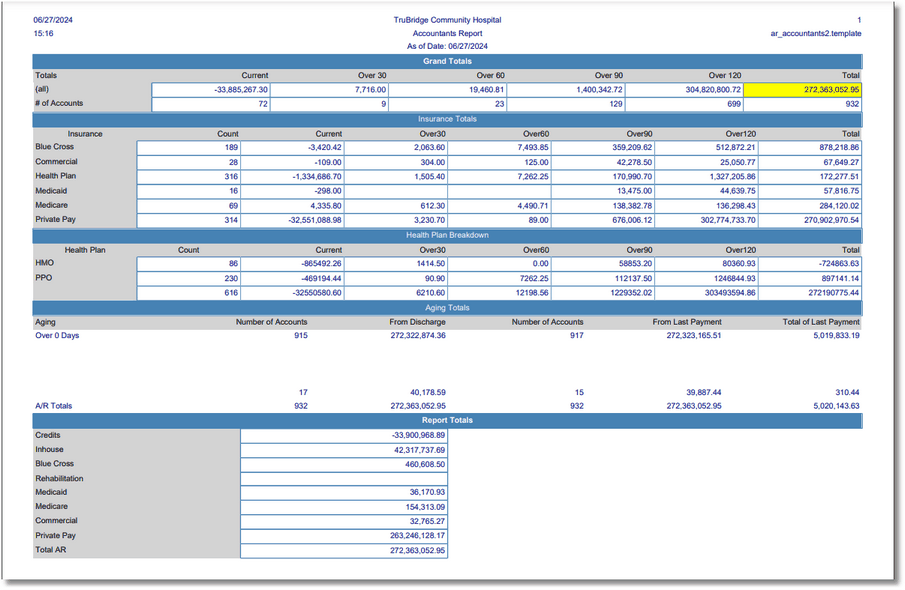

Totals Section

•Grand Totals: The total dollar amounts and total number of accounts by aging period.

•Insurance Totals: The total number of accounts by insurance and the total dollar amounts by insurance and aging periods The aging period amounts are based on discharge date.

•Health Plan Breakdown: The total number of accounts by health plan and the total dollar amounts by health plan and aging periods.

NOTE: The Health Plan Breakdown totals will only display when a Health Plan has been defined on page 3 of the Insurance Company Table.

Aging Totals

•Aging: The aging buckets that are entered when running the report.

•Number of Accounts (From Discharge): The number of accounts included in the aging bucket from discharge.

•From Discharge: The total dollar amount of accounts included in the aging bucket from discharge.

•Number of Accounts (From Last Payment): The number of accounts included in the aging bucket from last payment.

•From Last Payment: The total dollar amount of accounts included in the aging bucket since last payment.

•Total of Last Payment: The total dollar amount of payments received in the aging bucket.

NOTE: If aging buckets are not defined, all accounts will be included in the Over 0 days bucket.

Report Totals

The Report Type used to classify the account to summarize the totals. The dollar amounts for each Report Type are based on the total account balance as of the date the report was run.